The Economics of Search

I love the music here at SMX. It’s awesome.

It’s time for my brain to explode. Moderator Chris Sherman, Search Engine Land and speakers Peter A Coles, Harvard Business School; Michael Schwarz, Yahoo! Research and Hal Varian, Google will all prove how much smarter they are than me.

Mike McDonald, WebProNews will be moderating the Q&A for all the ‘um, what?’ questions. Mark Mahaney from Citigroup Investment Research is also joining us as well.

Chris Sherman starts us off with why they’re doing this session in the first place. Many search marketers know the marketing side but they don’t know the other side of the equation, what are the engines thinking about, how do they make money?

Michael Schwarz is up first. He’s a marketplace designer. You can complain to him about the interface. He says there are two main questions to ask, one hard, one easy. How do we balance the interests of advertisers and search engines? And what are the key areas of economics involved?

There is no tradeoff in his mind between revenue and satisfying advertisers and users. Maximizing value delivered to user and advertisers approximately maximizes search engine’s profits (a theorem, not a slogan).

Do the interests ever conflict? He’d like to have an example but overall he thinks that there are usually small variations if any.

What’s the future of sponsored search?

The main competitor of Google and Yahoo in sponsored search is organic listings. If search comes to dominate the SS, the business model will have to change. The reason people click on sponsored listing is because they’re good answers to the query. In a nutshell, people click on sponsored search is because organic search sucks.

Organic search is easy to spam, but sponsored isn’t so much because you have to put your money where your mouth is. One of these days someone may figure out organic search and then sponsored search will be in trouble.

The Major Challenges

- Making SS more relevant

- Better measures of user experience

- Better advertiser tools

- More targeting, smarter advanced match.

Targeting is sort of a two edged sword. The problem is that you’re being smart and targeting only your area. But someone who isn’t as smart isn’t targeting and he’s everywhere and getting more non-converting traffic.

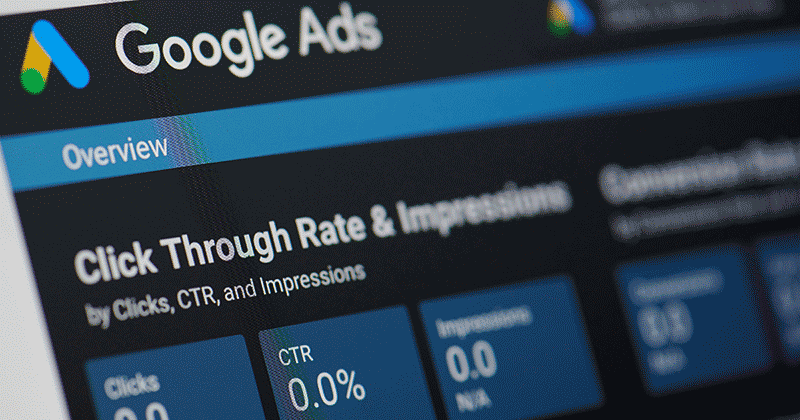

Convergence of search and display advertisement is coming. Right now, they couldn’t be more different. Search about current intent, display is about demographics. Search for DR, Display is for branding. Search is spot market, display contracts. Even pricing is vastly different. Historically Search was selling for 5c and up. Display for $5000 and up. They have different buyers and different sellers. But convergence is still happening. There’s behavioral targeting going on in display and branding going on in sponsored search.

So that’s where the future of sponsored search is.

Hal Varian steps up to the mike next.

He says he learned when he was a professor to never teach an economics class at four in the afternoon. It’s 3:30. Talk fast. ;)

He’s going to talk about how to bid on Adwords. I’ll skip most of this because it’s all very basic: base it on real search behavior, use long tail keywords, popular keywords aren’t always the most effective. Look at the cost per conversion and compare it to the value per acquisition. The value of a click is the probability of a conversion.

How do you determine what your bid should be? …oh wow, math. This was such a bad idea to try to blog this session.

The important thing is the extra cost you pay for the extra clicks is important. You want to bid until the value per click is equal to the incremental cost per click. You’ll need to experiment to find this.

Google wants to be giving you better guidance in the future. In my case, I think that means I need to go back to basic math.

If you’re hitting a budget constraint all the time, you’re doing something wrong. Raise it or lower your bid. If you’re making money, why do you have a budget constraint?

Peter Coles is next. Talk slowly, Peter. Please.

He’s writing a new course for Harvard right now. Entrepreneurial Market Design. Nifty.

In ad platforms there are two distinct groups. Neither wishes to join without the other. In this case, it’s Advertisers and Publishers. As an advertiser, you don’t want to join a network if it doesn’t have a good reach. As a publisher, the greater number of advertisers, the better your bids are going to be.

Will participants join more than one platform at the same time? For publishers, generally not. They have a limited amount of space that can be used for ads. Advertisers, possibly. You’re making a choice between cost vs reach. You have to set up and maintain. Costs are linear in the number of ad platforms. That means joining two networks is twice as expensive as one.

Entering into this world as a network is a chicken and egg problem. No one wants to be the first. Mobilizing the network is particularly challenging when there are strong cross side network effects.

Exacerbating the problem is that publishers are focused on short term profits.

So how do you get around it? You can buy someone else (Like say, oh Microsoft buying Yahoo.). You can focus first on one side: flagship tenant (like BEING Microsoft.)

Differentiation is a double edged sword. For example the length of the text ads. It may have been helpful but it caused problems between people trying to maintain campaigns in more than one networks.

You can try to get in via segmentation. Focus on just one market, like Stubhub did for tickets.

Cross subsidization: Make deals with low profits or margins now to produce benefits elsewhere within the network. Essentially, take less profit in order to grow.

He summarizes quickly all the above problems and possible solutions.

Mark Mahaney from Citigroup Investment Research steps up next. In 2007, direct marketing was $60 billion. $40 billion was spent in newspapers. Yellow pages $20 billion. That’s the value of internet marketing because all that’s going to move online. E-retail is not recession proof but it’s growing. Online travel is growing 14% year over year as well.

Google is large enough as a percentage of the US economy that it shouldn’t be surprising that it’s going to be impacted by the recession. People are buying less, cutting back. They’re naturally going to be searching less.

One mobile search per handset per month in 2010, you’re looking at $2.5 billion. At ten searches a month, you’re making more than PC based searches. (which is at 35 searches per month right now.)

He thinks that there is no way that Microsoft isn’t going to acquire Yahoo. 55% probability.

The impact of a possible MicroHoo! on GOOG:

Will MicroHoo! lead to a search query shift among customers? Probably not

Will MicroHoo! R&D mashup create a better search engine? He’s skeptical

Could a larger #2 search engine draw search budgets away from Google? This is the big factor. People might move there because of the stronger secondary market.

Q&A

Would MicroHoo! benefit Ask?

Mark: I think this is going to cause a lot of disruption. Nothing’s going to happen before 2010. It’s hard to see how it could benefit Ask. It’s hard to see how long term how Ask survives as a scalable search engines. [AN: Harsh.]

Why is it taking so long to better help the advertisers?

Hal: We’re committed to providing better tools. When you’re operating at our scale, it’s tough and you want it right on day one.

Michael: I’d love to chat afterwards. Oftentimes one size doesn’t fit all, which means that sometimes by offering a tool we’re going to be making your life harder instead of easier. If we offer a tool and it’s perfect for 10% of the population, then it would be wasting the time of 90% of the population.

LEAVE A REPLY